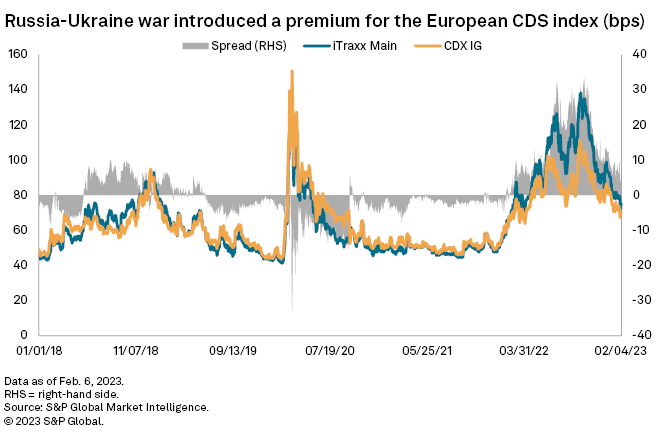

Web We infer the likelihood of a US Default from these CDS premiums and estimate an increase in the market-implied default probability from about 0304 in 2022 to about 4 in April 2023 which is. Web We infer the likelihood of a US Default from these CDS premiums and estimate an increase in the market-implied default probability from about 0304 in 2022 to around 4 in April. Web Based on data collected by the BIS 2021 notional amounts outstanding in the global credit default swap market totaled close to 85 trillion at the end of 2020 with a little more than half. Web Investors are set to jump into credit default swap indices again in 2023 after a lagging bond market drove record trading volume last year Some 30 trillion in volume was traded. Web Credit Default Swap Market Size Share Competitive Landscape and Trend Analysis Report by Type and by End User Global Opportunity Analysis and Industry Forecast 2023-2032..

Web We infer the likelihood of a US Default from these CDS premiums and estimate an increase in the market-implied default probability from about 0304 in 2022 to about 4 in April 2023 which is. Web We infer the likelihood of a US Default from these CDS premiums and estimate an increase in the market-implied default probability from about 0304 in 2022 to around 4 in April. Web Based on data collected by the BIS 2021 notional amounts outstanding in the global credit default swap market totaled close to 85 trillion at the end of 2020 with a little more than half. Web Investors are set to jump into credit default swap indices again in 2023 after a lagging bond market drove record trading volume last year Some 30 trillion in volume was traded. Web Credit Default Swap Market Size Share Competitive Landscape and Trend Analysis Report by Type and by End User Global Opportunity Analysis and Industry Forecast 2023-2032..

The India 5 Years CDS value is. Operational Directions for Credit Default Swaps in the OTC market 81 Buying Unwinding and Settlement. 143 kb Draft Guidelines on Credit Default Swaps for Corporate Bonds. Credit Default Swaps are financial derivatives that allow investors to. Credit Default Swap Market Size Share Competitive Landscape and Trend Analysis Report by Type and by End..

Result A credit default swap is a derivative contract that transfers the credit exposure of fixed income products It may involve bonds or forms of. Result A credit default swap CDS is a financial swap agreement that the seller of the CDS will compensate the buyer in the event of a debt default by the debtor or other. Result A credit default swap CDS is a contract that allows one party an investor to transfer some or all risk to a third party for a period of time. Result The credit default swap market is generally divided into three sectors Single-credit CDS referencing specific corporates bank credits and sovereigns. Result Credit default swaps CDS are a type of financial derivative that provides insurance against the risk of default on a debt obligation..

Comments